newsitems

newsitems  ECB new President Draghi to EU Parliament: €uroArea can face the Global Crisis with a 3 steps Plan

ECB new President Draghi to EU Parliament: €uroArea can face the Global Crisis with a 3 steps Plan

ECB new President Draghi to EU Parliament: €uroArea can face the Global Crisis with a 3 steps Plan

Clearly and pedagogically replying to MEPs' questions in EU Parliament's Economic and Monetary Committee, the new ECB President, Mario Draghi, carefully but optimistically, focused mainly into stressing that, despite the "Serious" risks at the present Global Crisis, €uroArea can succeed to face the challenge "if" it acts with "a well-coordinated, coherent and properly timed strategy", as it has already started to do, at least during the recent Months. While controversial UK-USA Rating Agencies should not be taken so seriously and would better face some Competition as French a.o. MEPs ask. And Greece's controversial PASOK Economic Plan on how to meet the overal Financial Targets agreed with the EU on October 2011 had better be reviewed, as he observed, after reiterating the general ESRB's call launched since late December 2011, as "EuroFora" had immediately reported (see relevant previous NewsReport).

After concluding, a smiling Draghi tried in vain to pose a while at least for an "EuroFora" Photo, but was immediately '"bombarded" by several more MEPs' questions up to EU Parliament's long corridors...

In particular :

------------------------

UKUSA Rating Agencies lost Reputation

-------------------------------------

Replying to a critical question by EPP Party representative, mainstream French MEP Gauzes, on the 3 UK-USA Rating Agencies, President Draghi observed from the outset that "all the Rating Agencies had a terrible Loss of Reputation, over the last (Global) Crisis,

Therefore, we should learn either to live without them, or to use them only at a lesser extend, among many other information sources. So, much less Mechanical reliance on them", he advised.

And the fact that we don't have Competition in the Rating Industry, is really an issue, Draghi criticaly observed.

=> - "So, whatever we do to increase this Competition, is well done", ECB's new President stressed, speaking in Strasbourg the same Day that the Leader of French Governing Party UMP's MEPs, Jean-Pierre Audy, just reiterated his call for the EU to support the Creation of a European, Independent and professional Rating Agency, while also advancing the idea for the establishment of a New, World-wide Rating mecanism supported by the IMF and/or the UNO.

------------

Draghi : 3 steps Plan for €uroArea, (focused on Structural Reforms)

-------------------

But, the most interesting of all was Draghi's overall presentation on what shoud be €urozone's overall Action Plan, that he highlighted in reaction to the claim launched by Socialist MEP Bullmann éthat, "WIthout Investments, people have said that we'll slip in a kind of visious circle", as he had said...

- "We have 3 sets of Actors ; If they all do and act consistently and effectively, then, we [EU) will reach Stabilisation", ECB's new President highlighted in reply :

------------------------

1st, National Governments. They have to put into place serious Fiscal Consolidation Plans.

What one sees accross Europe is Encouraging. Basically, Governments show a will and a Determination in pursuing Fiscal Determination in different (EU) Countries.

However, we shouldn't deny the Truth : Fiscal Consolidation, if it's strong, as needed, this will have a "Short Term output Contractionary effects", as he noted.

----------------------

=> So, what can we do to Mitigate these efffects ? An answer is that Economic Reform should be made also with Structural Reforms that increase Competitiveness, enhance Growth, and create Jobs.

Growth and Job creation in a area where Unemployment aproaches 10%; becomes more and more an objective to be pursued, together with consolidation of Budgets.

In fact, Growth and Stability are Complementary to eachother. Because there can't be any Sustainable Financial Stability without Growth", (as f.ex. the case of Greece also proved recently).

That's the 2nd part.

---------------------------

+ The 3rd Actor, is a sort of "FireWall" , in the sovereign bonds' Market, ECB's new President added.

Because, we started this situation when Debts became big, but, during a certain period of Time, Markets are still "fragile" ("not only in Europe, but all over the World"), and, clearly, more than 5 Years ago, you practicaly didn't have but only some tiny spreads, since they were Not reflecting the Differend Risks.

But, then, after the Lehman brothers' crisis (in the USA), the perception of Risks Hightened, Investors started thinking that some had lied to them, Spreads started to grow dramatically, and, from Under-Shooting, (as previously), now they went towards Over-Shooting the differences in Interest Rates.

=> Therefore, there will be a Time when a "FireWall" would be really Useful, Draghi warned.

Because you'll have to avoid a moment when the Cost of Credit would be geared not to the Short-term, as we (ECB) do when we lend to Banks, but to the Alternative Investment, which is a Government Bond. So that the Cost of Credit would reflect the Higher level : i.e. the Government Bond, and not the Lowest Rate that we (ECB) ask the Banks to pay for that, he explained.

------------

=> As for the 500 Billion € move made recently by the ECB, (See 12/2011 "EuroFora"s NewsReport), it "is functioning", but we have to give it some Time yet. We (ECB) actually view it as being an Effective Measure, and we have several Proofs about it, he added.

Let me resume the Measures we took during the last 2 Months :

- We launched the unprecedented 3 Years Liquidity Facility, at 1% interest rate,

- We have halved (-50%) the Minimum Reserve requiry Ratio, from 2% tp 1%, so that it wil Free more than 100 Bilions € in collateral.

- We have broadened the Collateral Rules so that even Banks which are not Big enough, ca, actually access to the collateral, to the ReFinancing Facilities. (The reason being that the Traditional conceptions of collateral were only accessible to the very Big Banks).

So, we've done this for 2 main Reasons :

* 1st of all, we see that the key Refinancing Markets for Banks are Blocked.

=> So, we think that (with the December 29, 2011 Measure : See "EuroFora"s relevant NewsReport then), "we have avoided a Major Credit Crush", as there was an Emergency, (particularly with 200 Billions € Bonds coming in the first of theses two months). ...

* 2nd aim of that was to reach the target of Small-Medium Banks, who mainly fund SMEs, responsible for 60% to 70% of Jobs.

+ Some claim that the Money wasn't used because it was largely deposed back to the ECB. But, in fact, it's not the same Banks who took, and those who deposed Money back. So, meanwhile, the Money has circulated.

>>> From many points of view, we (ECB) are Satisfied by the efficiency of that Measure", Draghi concluded in reply to an EuroSceptic British Conservative MEP.

----------------

Last but not least, questioned by MEP Lamberts on the situation of "Private Debts" in EU Countries, Draghi replied that there are All sorts of very Differend Situations, in this regard, going from those where the situations seems "out of control", up to EU "Countries which have the Smallest Private Debt in all the Western World", (i.e. a Record- High Private Lending Capacity), such as, notoriously, Italy and France, etc., which reportedly have among the Best and Strongest Private Savings in the World....

-------------------------------

New ECB President on "Greece" : Review the controversial October 2011 ("PASOK") Economic Plan on how to meet the Financial Deal agreed with the EU

---------------------------------

+ Finally, making just some "General" comments on Greece, in reply to a Question by MEP Chountis, (Left), ECB President started by observing that the October 2011 apraisal (of sustainability of the Greek Debt) had to be reviewed, "in view of the Fact that the Greek Program (which had been presented by the former PASOK Prime Minister Giorgos Papandreou, provoking unprecedented Popular Revolts and worse than expected Recession), both because of Lack of Growth, and of some non-implementation in part, is Not Delivering as expected", and this is part of the current Negotiations with the Private sector".

The controversy seems to focus on the controversial and inefficient, concrete Economic Measures and the practical way with which the G. Papandreoy "PASOK" Government had sought to meet the overall Financial Targets agreed with the EU, and not these targets in themselves, (Comp. the "Cannes Formula" suggested by "EuroFora" since the November 2011 Top meetings on the sidelines of the G20 Summit, and apparently endorsed by French President Sarkozy and the main opposition leader Samaras, etc).

Thus, a Realistic outcome would be an outcome which would guild, with a sufficient degree of realism, a Debt with a GDP Ratio of 120%, by 2020. This is a "realistic" outcome in the case of Greece, Draghi stressed in this regard, but without Time to explain in detail.

However, the overall estimation of ECB's President was that, in principle, a realistic outcome in the case of Greece was "possible". (Comp. "EuroFora"s latest NewsReport from Berlin+).

(NDLR : "DraftNews", as already sent earlier to "EuroFora"'s Subscribers/Donors. A more accurate and complete, Final Version, may come asap).

***

Main Menu

Home Press Deontology/Ethics 2009 Innovation Year EU endorses EuroFora's idea Multi-Lingual FORUM Subscribers/Donors FAQs Advanced search EuroFora supports Seabird newsitems In Brief European Headquarters' MAPs CoE Journalists Protection PlatformBRIEF NEWS

- 00:00 - 02.06.2021

- 00:00 - 18.10.2020

- 00:00 - 19.06.2020

- 00:00 - 18.05.2020

- 00:00 - 20.04.2020

- 00:00 - 02.02.2020

- 00:00 - 09.12.2019

- 00:00 - 27.11.2019

- 00:00 - 16.11.2019

Popular

- Yes, we could have prevented Ferguson riots says World Democracy Forum's Young American NGO to ERFRA

- Spanish People Elect CenterRIGHT Majority with 1st Party and Total of 178 MPs (6 More than the Left)

- Pflimlin's vision

- The European Athletic "Dream Team", after Barcelona 2010 Sport Championship Results

- Source Conseil d'Europe à ERFRA: Debatre Liberté d'Opposants à Loi livrant Mariage+Enfants à Homos ?

- Head of BioEthics InterGroup, MEP Peter Liese : "Embryonic stem cell research reaching its END" !?

- Spain: Jailed Turkish Terror suspect with Explosive,Drones,Chechen accomplices stirs Merah+ Burgas ?

- UN Head Ban Ki Moon at CoE World Democracy Forum : - "Listen to the People !"

Latest News

- EUOmbudsmen Conference 2022: Digital Gaps affect People's Trust threaten EF Project on EU Future ?

- French Election : Black Out on Virus, but Obligation for Fake 'Vaccines" Challenged

- Both French Presidential Candidates point at "Humanism" in crucial times...

- France : Zemmour = Outsider may become Game Changer in Presidential + Parliamentary Elections 2022

- PACE President Cox skips Turkey Worst (Occupation) case compared to Russia (DeMilitarisation) query

Statistics

Visitors: 59356110Archive

Login Form

Other Menu

*Paris/ACM/12 October 2008/-

When Europeans really feel a vital need to urgently launch common replies to challenging World Crisis, as the present Financial turmoil of Global Markets, they forge new decision-making tools and new dynamics :

The 1st in History EuroZone Heads of State and Government Summit, organized in Paris at the invitation of French President, and current EU chair, Nicolas Sarkozy, with the participation of 15 national leaders and EU institutions' chairmen, partly enlarged to British Prime Minister Gordon Brown, after a highly symbolic duo with German Chancelor Angie Merkel, at General De Gaulle's birth-village, 50 Years after he welcomed there former German chancellor Adenauer (1958-2008), may have not one, but two results :

- The first, and more urgent, was to launch an "ambitious", "coherent", and "efficient" common European movement, able to stimulate "solutions" to the World Economic Crisis, as Sarkozy anounced from the outset : State Garantees (to new Bank debts up to 5 years), fresh Capital input (f.ex. by buying shares), support to distressed banks, (while also restructuring them), incite the European Central Bank to facilitate commerial bills europe-wide, etc.

"Acting swiftly", from tomorrow, national measures will quantify all these targets, with coordinated actions from all EuroZone's Governments : France, Germany, Italy and others, decided to anounce, at the same time, such concrete measures, according to agreements that we have already made all together, revealed Sarkozy at the final Press Conference, flanked by EuroZone's chairmen : EuroGroup's Jean-Claude Juncker, and Central European Bank's Jean-Claude Truchet, as well as EU Commission's Jose Baroso, to solemnly stress the will to find common European solutions.

- "United and Determined, all EuroZone's Countries will act to prove that Citizens can Trust" the Economy, Sarkozy concluded. If we attract also all EU's 27 countries, Wednesday in Brussels, then we can coordinate action with our American Friends at a Global level, he anounced.

- "With this new Toolbox, we do not want to serve Bankers, but to work for Europe and its Citizens' interests", added Juncker.

- "For the moment, we want to act urgently to regulate the Crisis. But the time will come when those responsible for this, will have to account for their actions. Yes to real Capitalism, No to Speculators. Those who abused, will face sanctions, Sarkozy warned.

Need stimulates activities which create new organs, say biologists, and Gordon Brown, compatriot of Spencer, the famous bio-Historian, would certainly not deny that, after his surprise visit to EuroZone's Summit in Paris, which attracted him one hour more than scheduled...

Decisions include also the creation of a Crisis-management European mechanism, which "requires constant Monitoring", as well as strengthening Economic policy cooperation between EuroZone's countries.

Sarkozy will be judged by History not just by the immediate Economic results, expected at the end of this week's decision-making proces at National and EU level, but also by the more far-reaching consequences at the aftermath of this Historic EuroZone 1st Summit : Will it succeed to become a precursor forging a New era in European institution's revitalization ?

Significantly, the French President sat, during discussions, between German Chancelor Merkel, and British Prime Minister Brown, facing the chairmen of EuroGroup, Juncker, ECB : Truchet, and EU Commission, Baroso, with Prime Ministers of Spain, Zapatero (a hot partisan of EuroZone's Summit) at his right side, and Italy's Berlusconi, at his left, surrounded by Austrian, Belgian, Cyprus', Finland's, Greece's, and Ireland's leaders, as well as Slovakia's, Slovenia's, Portugal's, Netherlands', Malta's and Luxembourg's leaders.

Meanwhile, those who tabled for a rift between French and German positions were faced with a smiling Merkel at De Gaulle-Adenauer's meeting place, a sunny Saturday morning, and a particularly active-looking Merkel inside the French Presidential Palace at Elysee's gardens on Sunday, (as happy few photographers discovered)..

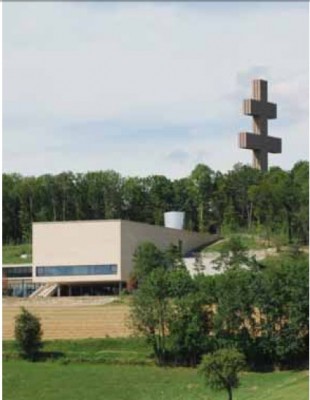

- "De Gaulle's hilltop, at Colombey-les-2-Eglises, gave an astonishing overview to a huge landscape, entirely surrounded by splendid Nature, as far as eyes could see", said to EuroFora an obviously charmed German Journalist.

She was describing Saturday's inauguration of a High-Tech Memorial close to the Historic Giant Double Lorraine's Cross, built by famous Novelist Andre Malraux, to perpetuate the Memory of his famous call for "Resistance" to NAZI, and his vision for the creation of New Institutions and Franco-German reconciliation, to foster Europe's role in the World, also for the Future.

Children playing at Elysee's gardens before the Historic 1st EuroZone's Summit : What Europe's Future will look like ?